Investors Charter

1. Vision:

Towards making Indian Securities Market – Transparent, Efficient, & Investor friendly by providing safe, reliable, transparent and trusted record keeping platform for investors to hold and transfer securities in dematerialized form.

2. Mission

- To hold securities of investors in dematerialised form and facilitate its transfer, while ensuring safekeeping of securities and protecting interest of investors.

- To provide timely and accurate information to investors with regard to their holding and transfer of securities held by them.

- To provide the highest standards of investor education, investor awareness and timely services so as to enhance Investor Protection and create awareness about Investor Rights.

3. Details of business transacted by the Depository and Depository Participant (DP)

A Depository is an organization which holds securities of investors in electronic form. Depositories provide services to various market participants – Exchanges, Clearing Corporations, Depository Participants (DPs), Issuers and Investors in both primary as well as secondary markets. The depository carries out its activities through its agents which are known as Depository Participants (DP). Details available on the link https://www.cdslindia.com/DP/dplist.aspx

4. Description of services provided by the Depository through Depository Participants (DP) to investors

1) Basic Services

| Sr.No. | Brief about the Activity/ Services | Expected Timelines for processing by the DP after receipt of proper documents |

|---|---|---|

| 1 | Dematerialization of securities | 7 Days |

| 2 | Rematerialization of securities | 7 Days |

| 3 | Mutual Fund Conversion / Destatementization | 5 Days |

| 4 | Re-conversion / Restatementisation of Mutual fund units | 7 Days |

| 5 | Transmission of securities | 7 Days |

| 6 | Registering pledge request | 15 Days |

| 7 | Closure of demat account | 30 Days |

| 8 | Settlement Instruction | For T+1 day settlements, Participants shall accept instructions from the Clients, in physical form up to 4 p.m. (in case of electronic instructions up to 6.00 p.m.) on T day for pay-in of securities. For T+0 day settlements, Participants shall accept EPI instructions from the clients, till 11:00 AM on T day. Note: ‘T’ refers ‘Trade Day’ |

2) Depositories provide special services like pledge, hypothecation, internet based services etc. in addition to their core services and these include

| Sr.No. | Type of Activity /Service | Brief about the Activity/ Services |

|---|---|---|

| 1 | Value Added Service | Depositories also provide value added services such as:

|

| 2 | Consolidated Account statement (CAS) | CAS is issued 10 days from the end of the month (if there were transactions in the previous month) or half yearly (if no transactions). |

| 3 | Digitalization of services provided by the depositories | Depositories offer below technology solutions and e-facilities to their demat account holders through DPs: |

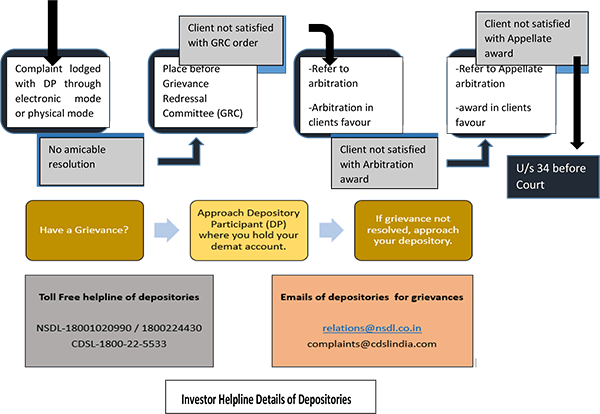

5. Details of Grievance Redressal Mechanism

1) The Process of investor grievance redressal

| Sr.No. | ||

|---|---|---|

| 1 | Investor Complaint/ Grievances | Investor can lodge complaint/ grievance against the Depository/DP in the following ways:

|

| 2 | Online Dispute Resolution (ODR) platform for online Conciliation and Arbitration | If the Investor is not satisfied with the resolution provided by DP or other Market Participants, then the Investor has the option to file the complaint/ grievance on SMARTODR platform for its resolution through by online conciliation or arbitration. |

| 3 | Steps to be followed in ODR for Review, Conciliation and Arbitration |

|

For the Multi-level complaint resolution mechanism available at the Depositories

6. Guidance pertaining to special circumstances related to market activities: Termination of the Depository Participant

Type of special circumstances –

Depositories to terminate the participation in case a participant no longer meets the eligibility criteria and/or any other grounds as mentioned in the bye laws like suspension of trading member by the Stock Exchanges. Participant surrenders the participation by its own wish.

Timelines for the Activity/ Services –

Client will have a right to transfer all its securities to any other Participant of its choice without any charges for the transfer within 30 days from the date of intimation by way of letter/email.

11. Code of Conduct for Depositories

(Part D of Third Schedule of SEBI (D & P) regulations, 2018)

-

Depository shall:

- Always abide by the provisions of the Act, Depositories Act, 1996, any Rules or Regulations framed thereunder, circulars, guidelines and any other directions issued by the Board from time to time.

- Adopt appropriate due diligence measures.

- Take effective measures to ensure implementation of proper risk management framework and good governance practices.

- Take appropriate measures towards investor protection and education of investors.

- Treat all its applicants/members in a fair and transparent manner.

- Promptly inform the Board of violations of the provisions of the Act, the Depositories Act, 1996, rules, regulations, circulars, guidelines or any other directions by any of its issuer or issuer’s agent.

- Take a proactive and responsible attitude towards safeguarding the interests of investors, integrity of depository’s systems and the securities market.

- Endeavor for introduction of best business practices amongst itself and its members

- Act in utmost good faith and shall avoid conflict of interest in the conduct of its functions

- Not indulge in unfair competition, which is likely to harm the interests of any other Depository, their participants or investors or is likely to place them in a disadvantageous position while competing for or executing any assignment.

- Segregate roles and responsibilities of key management personnel within the depository including:

- Clearly mapping legal and regulatory duties to the concerned position

- Defining delegation of powers to each position

- Assigning regulatory, risk management and compliance aspects to business and support teams

- Be responsible for the acts or omissions of its employees in respect of the conduct of its business.

- Monitor the compliance of the rules and regulations by the participants and shall further ensure that their conduct is in a manner that will safeguard the interest of investors and the securities market.

12. Code of Conduct for Participants

(Part A of Third Schedule of SEBI (D & P) regulations, 2018)

- A participant shall make all efforts to protect the interests of investors.

- A participant shall always endeavour to –

- render the best possible advice to the clients having regard to the client’s needs and the environments and his own professional skills;

- ensure that all professional dealings are effected in a prompt, effective and efficient manner;

- inquiries from investors are adequately dealt with;

- grievances of investors are redressed without any delay.

- A participant shall maintain high standards of integrity in all its dealings with its clients and other intermediaries, in the conduct of its business.

- A participant shall be prompt and diligent in opening of a beneficial owner account, dispatch of the dematerialisation request form, rematerialisation request form and execution of debit instruction slip and in all the other activities undertaken by him on behalf of the beneficial owners.

- A participant shall endeavour to resolve all the complaints against it or in respect of the activities carried out by it as quickly as possible, and not later than one month of receipt.

- A participant shall not increase charges/fees for the services rendered without proper advance notice to the beneficial owners.

- A participant shall not indulge in any unfair competition, which is likely to harm the interests of other participants or investors or is likely to place such other participants in a disadvantageous position while competing for or executing any assignment.

- A participant shall not make any exaggerated statement whether oral or written to the clients either about its qualifications or capability to render certain services or about its achievements in regard to services rendered to other clients.

- A participant shall not divulge to other clients, press or any other person any information about its clients which has come to its knowledge except with the approval/authorisation of the clients or when it is required to disclose the information under the requirements of any Act, Rules or Regulations.

- A participant shall co-operate with the Board as and when required.

- A participant shall maintain the required level of knowledge and competency and abide by the provisions of the Act, Rules, Regulations and circulars and directions issued by the Board. The participant shall also comply with the award of the Ombudsman passed under the Securities and Exchange Board of India (Ombudsman) Regulations, 2003.

- A participant shall not make any untrue statement or suppress any material fact in any documents, reports, papers or information furnished to the Board.

- A participant shall not neglect or fail or refuse to submit to the Board or other agencies with which it is registered, such books, documents, correspondence, and papers or any part thereof as may be demanded/requested from time to time.

- A participant shall ensure that the Board is promptly informed about any action, legal proceedings, etc., initiated against it in respect of material breach or noncompliance by it, of any law, Rules, regulations, directions of the Board or of any other regulatory body.

- A participant shall maintain proper inward system for all types of mail received in all forms.

- A participant shall follow the maker — Checker concept in all of its activities to ensure the accuracy of the data and as a mechanism to check unauthorised transaction.

- A participant shall take adequate and necessary steps to ensure that continuity in data and record keeping is maintained and that the data or records are not lost or destroyed. It shall also ensure that for electronic records and data, upto- date back up is always available with it.

- A participant shall provide adequate freedom and powers to its compliance officer for the effective discharge of his duties.

- A participant shall ensure that it has satisfactory internal control procedures in place as well as adequate financial and operational capabilities which can be reasonably expected to take care of any losses arising due to theft, fraud and other dishonest acts, professional misconduct or omissions.

- A participant shall be responsible for the acts or omissions of its employees and agents in respect of the conduct of its business.

- A participant shall ensure that the senior management, particularly decision makers have access to all relevant information about the business on a timely basis.

- A participant shall ensure that good corporate policies and corporate governance are in place.

Investor charter stock broker

1. Vision:

To follow highest standards of ethics and compliances while facilitating the trading by clients in securities in a fair and transparent manner, so as to contribute in creation of wealth for investors.

2. Mission

- To provide high quality and dependable service through innovation, capacity enhancement and use of technology.

- To establish and maintain a relationship of trust and ethics with the investors.

- To observe highest standard of compliances and transparency.

- To always keep ‘protection of investors’ interest’ as goal while providing service.

- To ensure confidentiality of information shared by investors unless such information is required to be provided in furtherance of discharging legal obligations or investors have provided specific consent to share such information.

3. Services provided to Investors by stockbrokers include

- Execution of trades on behalf of investors.

- Issuance of Contract Notes.

- Issuance of intimations regarding margin due payments.

- Facilitate execution of early pay-in obligation instructions.

- Periodic Settlement of client’s funds.

- Issuance of retention statement of funds at the time of settlement.

- Risk management systems to mitigate operational and market risk.

- Facilitate client profile changes in the system as instructed by the client.

- Information sharing with the client w.r.t. relevant Market Infrastructure Institutions (MII) circulars.

- Provide a copy of Rights & Obligations document to the client.

- Communicating Most Important terms and Conditions (MITC) to the client.

- Redressal of Investor’s grievances