Importance of Lok Sabha Elections on Market Fluctuations

The Lok Sabha elections serve as a critical factor influencing market fluctuations, influenced by corporate disclosures, shifts in sentiment, and the outcomes of pre-election polls. The current general election has garnered increased attention owing to India’s geopolitical significance, its role in emerging markets, and the competition for Prime Minister Modi’s third consecutive term in office.

The period leading up to elections often presents favourable conditions for engaging with the stock market. As the 2024 elections draw near, market volatility becomes notably high, presenting investors with an opportune moment to capitalise on strategic buying and selling of stocks to optimise their investment portfolios.

Below is a list of eight stocks that show promise for investment Before the 2024 elections, which you can consider incorporating into your portfolio:

Stocks for Investment Before the 2024 Elections

- Larsen & Toubro (L&T) Larsen & Toubro Limited stands out as a promising contender for inclusion in your investment portfolio, especially amidst the backdrop of India’s growing infrastructure the sector, which has seen a significant capital infusion reaching Rs 11.1 trillion. Despite experiencing a commendable upswing of approximately 23% over the past six months, Larsen and Toubro are poised for further growth as the demand for infrastructure continues to surge within the nation.L&T has encountered a notable setback with a recent 9% decline in stock price however, it remains a compelling choice among election-oriented stock selections, offering the potential for substantial long-term returns. Presently, the stock is trading at Rs 3,608, boasting a substantial market capitalisation of 4.95L Cr.

- Ultratech Cement Amidst the rapid expansion of the infrastructure sector in India, Ultratech Cement emerges as a promising investment option for investors during the 2024 general elections. Despite experiencing relatively slower growth in recent months, the stock is anticipated to undergo a substantial uptick in value soon. Presently valued at Rs 9,700 per share, analysts predict that the stock may surpass the 10,241 mark, positioning it as one of the top choices for investment leading up to the 2024 general elections, particularly during instances of price drops.

- HDFC Bank HDFC Bank is India’s leading private-sector bank. It stands poised to benefit from the continued growth of the banking and financial sector within the nation. With the upcoming 2024 general elections on the horizon, investing in HDFC Bank presents a compelling opportunity for several reasons. Currently priced at Rs 1,509, the stock reflects a noteworthy decrease from its 52-week high of Rs 1,757, presenting investors with an attractive discounted rate. Despite the decline in the stock price in recent months, the underlying fundamentals of the company remain robust. Furthermore, following the merger of parent company HDFC Ltd. with HDFC Bank, the stock is anticipated to embark on a transformative trajectory, potentially leading to rapid price appreciation.

- State Bank of India (SBI Bank) The State Bank of India is one of the largest banks in India boasting a market capitalisation of Rs 7,15,218 Cr. It holds a robust position within the financial sector. With an impressive track record of strong fundamentals and a consistent uptrend in profits over recent years, SBI emerges as a key candidate for inclusion in your investment portfolio amidst the backdrop of the 2024 general elections. Presently valued at Rs 808 per share, the stock presents an intriguing opportunity for investors. Moreover, should political stability prevail throughout the elections, SBI is poised to potentially witness substantial growth in the post-election period.

- Jindal South West (JSW) Energy Limited In the Indian renewable energy sector, Jindal South West (JSW) Energy Limited stands out as a notable player, particularly in the sphere of solar energy generation. With the government’s commitment to bolster investments in the power and renewable energy sectors, evident through initiatives like the “PM Suryodaya Yojna,” stocks like JSW Energy are poised for notable growth in the coming years. Currently valued at Rs 600 per share, JSW Energy has exhibited impressive performance, delivering a remarkable return of 51% over the past six months.

- National Thermal Power Corporation (NTPC) Limited National Thermal Power Corporation (NTPC) Limited, boasts a market capitalisation of approximately 3.44 lakh crore. It is a key player in the energy sector and a promising stock to invest in Before the 2024 elections. Given the incessantly growing demand for energy in the nation, NTPC is poised to scale new heights. Currently priced at Rs 357 per share, the stock has demonstrated robust performance, yielding a noteworthy return of 52% over the preceding six months. Anticipations are high for further escalation in its value post-elections.

- Indian Railway Catering and Tourism Corporation Limited (IRCTC) Indian Railway Catering and Tourism Corporation Limited (IRCTC) is a great stock to be included in your portfolio during the election period. With a substantial portion of India’s population travelling between cities and villages to participate in the electoral process, the railway sector is poised to witness a notable surge in activity. Currently valued at Rs 1,044 per share, IRCTC has already registered an impressive 57% increase in value over the past six months, further enhancing its appeal as a compelling choice during the 2024 general elections.

Conclusion

To summarize, with the 2024 general elections around the corner, the stock market offers a wealth of potential opportunities for investors. Gainn Fintech is pleased to share its curated list of top stock picks for this election cycle, providing valuable insights into companies positioned for growth amidst the political landscape.

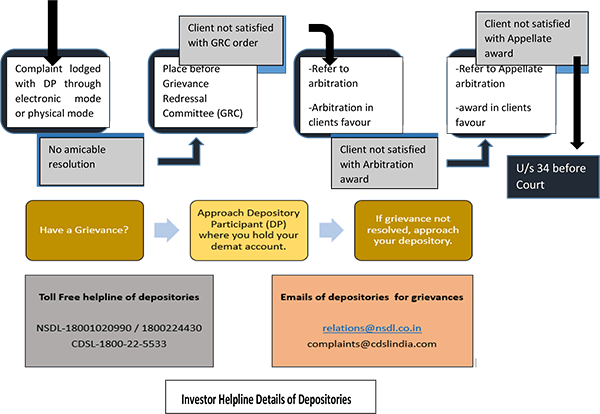

Investing through Gainn Fintech makes accessing the Indian Equity market convenient. Our platform empowers investors to make well-informed decisions by facilitating direct delivery of shares to their demat accounts and ensuring smooth corporate action processes.

By granting access to both the rapidly expanding Indian economy and the world’s largest economy simultaneously, Gainn Fintech facilitates portfolio diversification and allows investors to capitalise on wealth-building opportunities.

With Gainn Fintech, navigating the stock market during the general election season promises to be exceptionally rewarding. We invite you to join us today and embark on a journey towards financial success together.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.