If you’re a beginner looking to dip your toes into the exciting world of the stock market, you might be feeling a bit overwhelmed. But don’t worry, we’ve got you covered. In this post “Stock Market for Beginners”, we’ll walk you through the basics of getting started with stock market investing in India.

Introducing Stock Markets

First things first, let’s get some of the lingo out of the way. The stock market is a place where you can buy and sell shares of publicly traded companies. When you buy a share, you become a part-owner of that company and have the potential to earn profits through dividends and capital appreciation.

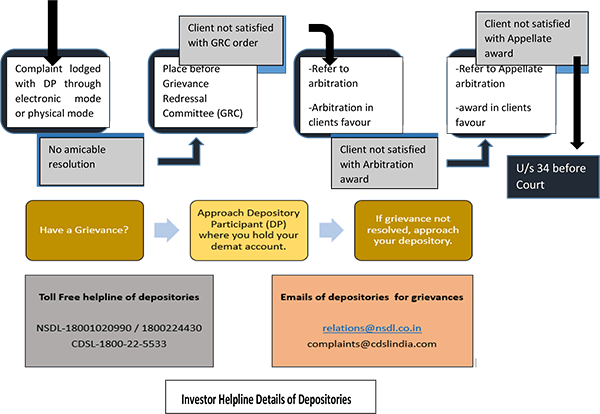

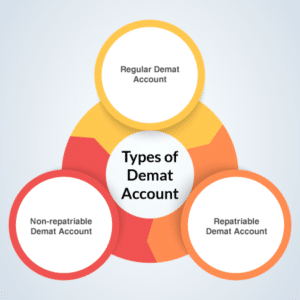

Demat Account

Now, let’s talk about how to actually get started with investing. The first step is to open a demat account, which is an account that allows you to hold and trade shares electronically. You can open a demat account through a broker (like MyGainn) or through a bank that offers this service.

Search Stocks

Once you have your demat account set up, it’s time to start researching stocks. With MyGainn, you have multiple tools to effectively identify stocks. You can also use a variety of sources like financial news websites, research reports, and social media groups. It’s important to do your due diligence and understand the fundamentals of the companies you’re considering investing in.

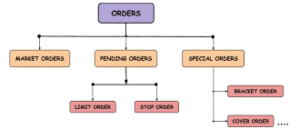

Types of Orders

When you’re ready to make a trade, you’ll need to place an order through your broker. There are two types of orders you can place:

A market order, which means you’ll buy or sell the stock at the current market price.

A limit order, which means you’ll specify the maximum price you’re willing to pay or the minimum price you’re willing to sell at.

Stop Loss Order, which means an order placed with a broker to sell a security automatically when it reaches a certain price point.

Exchanges

Exchanges

The Indian stock market consists of two major exchanges: the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). These exchanges offer a platform for trading equities, derivatives, currencies, and other financial instruments.

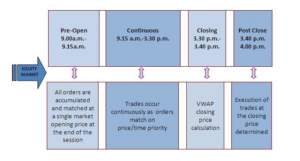

Working hours of the Indian stock market

The working hours of the Indian stock market are from 9:15 AM to 3:30 PM, Monday to Friday, except for public holidays. During these hours, traders can place buy and sell orders through their brokers.

Stock Market is Highly Volatile

Stock Market is Highly Volatile

As a beginner, it’s important to remember that the stock market can be volatile and unpredictable. It’s important to have a long-term investment strategy and not to get too caught up in short-term fluctuations.

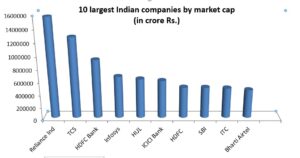

Identify Top Indian Sectors and Indian Companies

As a beginner, it’s important to start by researching the top companies listed on these exchanges. The top companies in India are typically classified as blue-chip stocks and are well-established, financially sound, and have a good track record.

| Rank | Company Name | Market Cap (in INR Crores) |

| 1 | Reliance Ind | 1563887 |

| 2 | TCS | 1266031 |

| 3 | HDFC Bank | 921311 |

| 4 | Infosys | 660879 |

| 5 | HUL | 620996 |

| 6 | ICICI Bank | 595707 |

| 7 | HDFC | 489783 |

| 8 | SBI | 486703 |

| 9 | ITC | 475829 |

| 10 | Bharti Airtel | 447656 |

It’s also important to research and understand the sectors in which these companies operate. Some of the top sectors in the Indian stock market include banking, IT services, consumer goods, healthcare, and infrastructure.

Taxation

Taxation

Another important aspect to consider is taxation. In India, gains from stock market investments are subject to capital gains tax, which varies depending on the holding period and the type of stock. It’s important to consult a tax advisor to understand the tax implications of your investments.

Conclusion

Overall, there are ample opportunities in Stock Market for Beginners. However, it’s important to do your due diligence, stay informed, and manage your risk to maximize your returns.

Exchanges

Exchanges