Managing Risk in the Stock Market: A Guide to Cover Orders

In the world of stock trading, Cover Orders (COs) are a popular tool used by traders to manage their risk and protect their positions. In India, Cover Order Trading is offered by most major brokers as a way for traders to limit their losses and maximize their profits.

Enjoy 2X Leverage On 475+ Stocks

Start Your Entrepreneurial Journey Now!

What is a Cover Order Trading?

A Cover Order is a type of order that is placed along with a regular buy or sell order. It is a two-legged order that consists of:

- A market order: The market order is used to enter or exit a position.

- A stop-loss order: The stop-loss order is used to limit potential losses

When a CO is executed, the stop-loss order is automatically placed at a predetermined level below the market price for a buy order or above the market price for a sell order.

Cover Orders working

Cover Orders work by providing traders with an added layer of protection against market volatility. When a trader places a CO, they are essentially placing a stop-loss order along with their market order. This means that if the market moves against them, their position will automatically be closed out at the predetermined stop-loss level. This can help limit potential losses and protect the trader’s capital.

Example

Let’s say you are a trader who wants to buy 100 shares of Reliance Industries, which is currently trading at Rs. 2,000 per share. You believe that the stock will go up, but you also want to limit your potential losses in case the market turns against you.

To do this, you can place a Cover Order with your broker. You can place a buy order for 100 shares of Reliance Industries at the market price, along with a stop-loss order for Rs. 1,900 per share.

This means that if the market price of Reliance Industries falls to Rs. 1,900 or below, your stop-loss order will be triggered, and your position will automatically be closed out at the best available price. This can help limit your potential losses and protect your capital.

Now let’s say that the market moves in your favor, and the price of Reliance Industries goes up to Rs. 2,200 per share. You can choose to exit your position at this point and realize a profit of Rs. 20,000 (Rs. 2,200 per share minus Rs. 2,000 per share multiplied by 100 shares).

Benefits

Some of the benefits of investing in mutual funds include:

1

Limit Potential Losses

The primary benefit of Cover Orders is that they limit potential losses by providing traders with a stop-loss order. This can help prevent large losses in the event of a sudden market downturn.

2

Increased Flexibility

Cover Orders provide traders with increased flexibility in managing their positions. By setting a stop-loss order at a predetermined level, traders can avoid the need to constantly monitor their positions and make manual adjustments.

3

Cost-Effective

Cover Orders are a cost-effective way to manage risk, as they do not require the trader to pay for additional margin or leverage.

Drawbacks

Limited Profits

While Cover Orders can limit potential losses, they can also limit potential profits. By setting a stop-loss order at a predetermined level, traders may miss out on potential gains if the market moves in their favor.

Slippage

Another drawback of Cover Orders is that they are subject to slippage. This can occur when the market moves quickly and the stop-loss order is executed at a price lower than the predetermined level for a buy order or higher than the predetermined level for a sell order.

Regulations

In India, Cover Orders are a popular tool used by traders in both the equity and derivatives markets. Most major brokers offer Cover Orders as a way for traders to manage their risk and protect their positions.

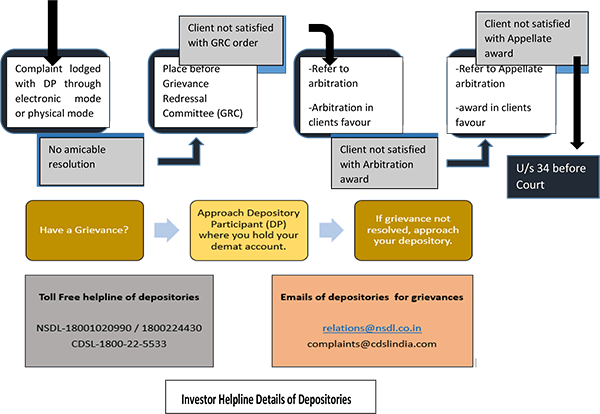

One important thing to note is that in India, Cover Orders are subject to additional regulations by the Securities and Exchange Board of India (SEBI). In 2017, SEBI introduced new rules for Cover Orders, requiring brokers to provide additional risk management tools and disclose more information about the potential risks and rewards of trading with Cover Orders.

Summary

Cover Orders are a valuable tool for traders looking to manage their risk and protect their positions in the market. While they have some drawbacks, such as limited potential profits and the risk of slippage, they can be a cost-effective and flexible way to manage risk. In the Indian context, Cover Orders are subject to additional regulations, but they remain a popular tool among traders in both the equity and derivatives markets.

With Gainn Fintech, get the maximum advantage of Cover Order Trading. The advanced high-tech tools of Gainn offers you the fastest and most simplified services like no other in the industry. Maximize the benefits of cover order trading with Gainn Fintech:

- Set realistic profit targets and stop-loss levels.

- Keep an eye on market trends.

- Monitor your trades closely.